Our Beliefs

At BMG we believe that a person’s credit worthiness should not be determined by simply looking at often misleading credit scores, rather we believe a more complete approach is necessary and look at factors such as employment, employer and income when evaluating prospective customers.

-

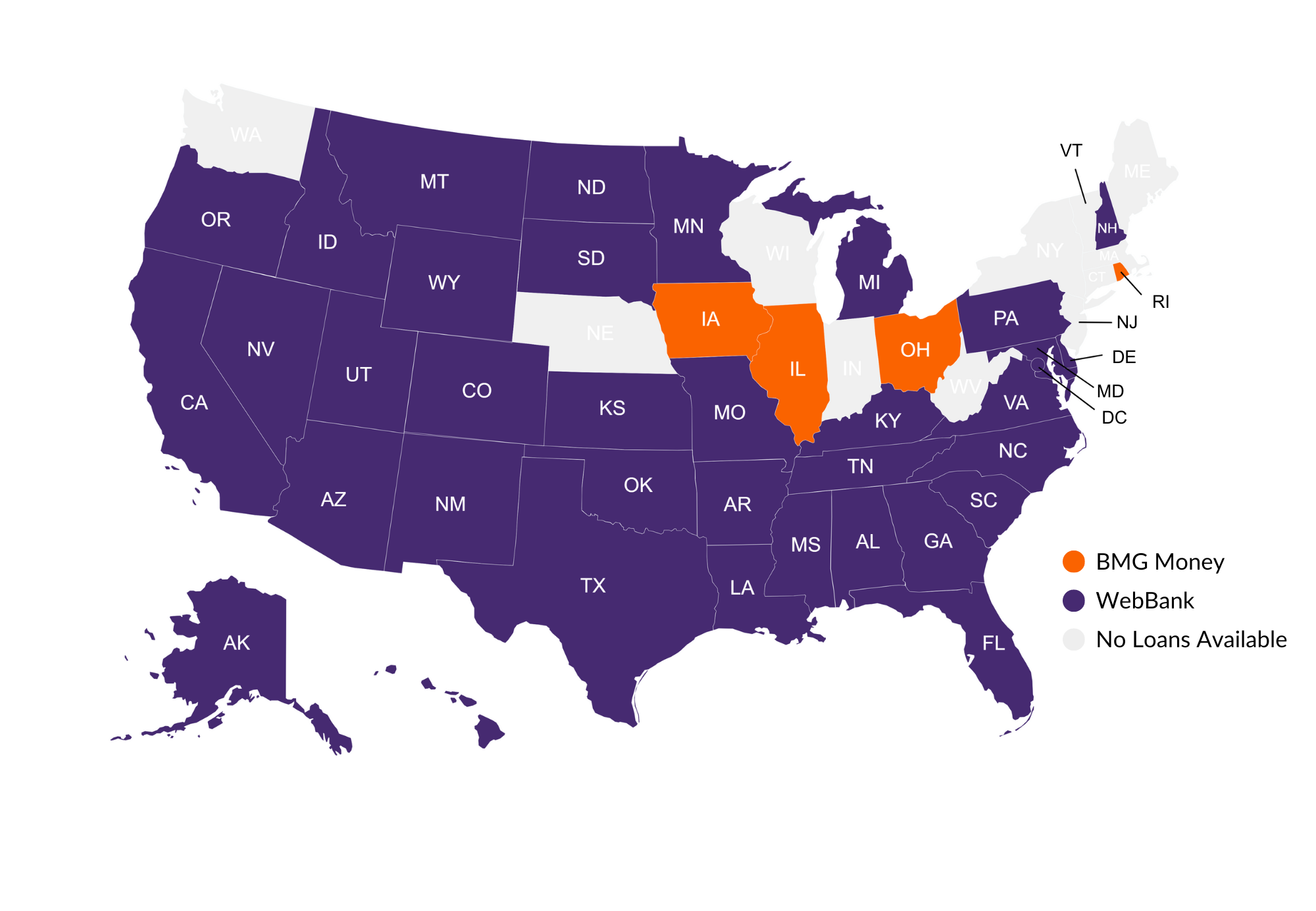

Doing Business in 42 States and D.C.

-

100+ Employer Partners

-

200k Customers Helped with Affordable Loans

-

120+ Dedicated Team Members

-

$4 Billion in affordable loans

.png)